Understanding the Cost of Living in Mexico: Budgeting for Expats in 2024

According to recent expatriate surveys, many North Americans are discovering they can live comfortably in Mexico for 50-70% less than their home countries. That means reducing your monthly expenses from $4,000 in a US city to potentially $1,500-$2,000 in a Mexican destination like Puerto Vallarta or San Miguel de Allende.

But here’s the critical thing: successful expat budgeting isn’t just about spending less. It’s about understanding the local economic landscape, making smart choices, and embracing a different lifestyle. This guide will walk you through everything I’ve learned about making Mexico an affordable destination.

Why Mexico? The Financial Appeal for Expats

When I first started researching expat destinations, Mexico wasn’t just a random choice – it was a calculated decision driven by financial realities.

The financial landscape in Mexico presents a compelling argument for relocation. Take housing, for instance. In cities like Merida or Guanajuato, you can rent a beautiful two-bedroom apartment for $500-$700 per month – a price that would barely cover a studio in many US metropolitan areas. But it’s not just about cheap rent.

The cost savings extend far beyond housing. Healthcare is a prime example. A typical doctor’s visit might cost $30-$50 out of pocket, compared to $150-$300 in the United States. Prescription medications are often 50-70% cheaper, and the quality of care is surprisingly high. I’ve spoken with expats who’ve saved thousands on medical expenses by simply crossing the border.

Transportation costs tell a similar story. Public transit is affordable and extensive. In most Mexican cities, you can get around using buses or shared transportation for pennies on the dollar compared to maintaining a car in North America. A monthly transit pass might run you $20-$30, compared to $100+ in many US cities.

Grocery expenses are another area of significant savings. Local markets offer fresh produce at prices that’ll surprise you. I’ve bought a week’s worth of fresh fruits, vegetables, and local proteins for less than $30 – something unimaginable in most US grocery stores.

Monthly Budget Breakdown: Essential Expenses

Budgeting as an expat isn’t about being cheap – it’s about being strategic. Let me share a typical monthly breakdown based on real expat experiences.

Housing typically represents your largest expense. In mid-sized Mexican cities, you’re looking at:

- Budget apartments: $300-$500 per month

- Mid-range apartments: $500-$800 per month

- Luxury apartments: $800-$1,500 per month

Utilities are refreshingly affordable, too. Electricity, water, and internet might total $100-$200 monthly, depending on your usage and location. I’ve spoken with expats who report spending less on total monthly utilities than they used to spend on electricity alone back home.

Groceries present another area of potential savings. A single person can eat exceptionally well on $200-$300 per month. This includes a mix of supermarket purchases and local market shopping. Pro tip: local markets are not just cheaper, but they’re also an incredible cultural experience.

Transportation costs vary by city. In walkable cities like San Miguel de Allende, you might spend just $30-$50 on monthly transportation. In larger cities with more complex transit systems, budget around $50-$100.

Healthcare is where Mexico truly shines for expats. Private health insurance can range from $50-$300 monthly, depending on coverage. Out-of-pocket medical expenses are so reasonable that many expats opt to pay directly rather than maintain comprehensive insurance.

Housing Costs Across Mexico: Where to Live Affordably

My journey through Mexico’s housing landscape taught me one crucial lesson: location is everything. Not all Mexican cities are created equal when it comes to living costs, and understanding these nuances can save you thousands.

Merida, Yucatan, is a sweet spot for expat living. Here, a comfortable two-bedroom apartment in a safe, attractive neighborhood might run you $500-$700 per month. Compare that to Mexico City, where similar accommodations could easily hit $1,000-$1,500, and you’ll see why location matters so much.

Coastal areas present interesting variations. Puerto Vallarta and Playa del Carmen attract more tourists, which drives up prices. Expect to pay a premium – around $800-$1,200 for a nice apartment. But when venturing slightly inland, prices drop dramatically.

Buying vs. renting is another critical consideration. Foreign ownership in Mexico is completely legal, but it comes with nuances. In most restricted zones (within 50 kilometers of the coast or borders), you’ll need a bank trust called a fideicomiso. The process sounds complicated, but it’s actually quite straightforward with the right guidance.

Some ballpark purchase prices:

- Small city condos: $75,000-$150,000

- Beachfront properties: $200,000-$500,000

- Colonial home renovations: $100,000-$250,000

Rental tip: Always negotiate. Landlords often prefer long-term tenants who will take care of the property. I’ve seen expats secure 10-20% discounts simply by offering a six-month or annual lease.

Daily Living Expenses: Food, Entertainment, and More

Food was my first love affair with Mexican living. Coming from a background of $15 lunch specials and $50 dinners, Mexico was a financial revelation. In local markets, I could buy a week’s worth of fresh produce for what I used to spend on a single restaurant meal.

Let’s break down typical food expenses:

- Local market grocery run: $30-$50 per week

- Dining out (local restaurant): $5-$10 per meal

- Nice restaurant dinner: $15-$25 per person

- Street food: $2-$4 per meal

Entertainment costs are equally surprising. A movie ticket might run $4-$6. Local concerts and cultural events are often free or extremely affordable. I’ve attended incredible music festivals and art shows for less than $10.

For gym memberships, expect $20-$50 monthly, compared to $100+ in many US cities. Cultural classes like dance or language lessons are incredibly affordable – often $10-$20 per session.

Healthcare and Insurance for Expats in Mexico

Healthcare was my biggest concern when first considering the move. The reality was far more impressive than I expected. Mexico offers a hybrid system that’s both affordable and high-quality.

Public healthcare through IMSS (Mexican social security) costs around $400-$600 annually. Private health insurance typically ranges from $500-$1,500 yearly, depending on age and coverage. Out-of-pocket medical visits? Shockingly affordable. A typical doctor’s consultation costs $30-$50.

Dental care is another pleasant surprise. A full cleaning might cost $30-$50, compared to $150-$200 in the US. More complex procedures cost a fraction of what you’d pay back home.

Hidden Costs and Financial Planning Tips

Visa renewals, banking fees, and unexpected expenses can quickly add up if you’re not prepared.

Key financial planning considerations:

- Visa renewal costs: $150-$300 annually

- Banking transfer fees: $20-$50 per international transfer

- Emergency fund recommendation: $5,000-$10,000 USD

Pro tip: Use local banks and get a Mexican bank account. Transfer fees drop dramatically, and you’ll have easier access to local financial services.

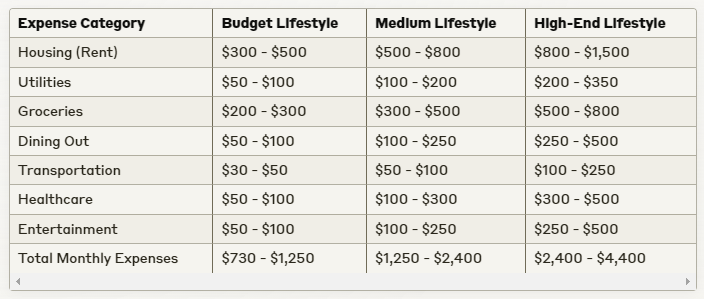

Typical Monthly Living Costs in Mexico: Lifestyle Comparison

A few insights about this table:

- Budget Lifestyle: Ideal for minimalist expats, digital nomads, or retirees on a tight budget

- Medium Lifestyle: Most common for expats seeking comfort with moderate expenses

- High-End Lifestyle: Comparable to upper-middle-class living in major Mexican cities

Each lifestyle offers unique advantages, and the beauty of Mexico is its flexibility. You can easily shift between these levels depending on your income and preferences.

Conclusion

Mexico isn’t just a destination – it’s a lifestyle redesign. By understanding the true cost of living, you’re not just saving money. You’re investing in an experience that offers cultural richness, personal growth, and financial freedom.